Cyber Market Remains Competitive, According to Council Survey

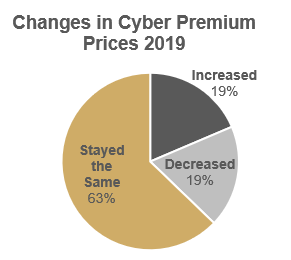

In a firming market, with slight-to-moderate premium pricing increases across the board, cyber coverage remained competitive over the last six months, according to The Council’s most recent Cyber Market Watch Survey. Sixty-three (63) percent of respondents noted premium prices for commercial cyber insurance “stayed the same” over the last six months.

Additionally, more commercial insurance buyers appeared to purchase cyber coverage in the last six months. Forty-two (42) percent of respondents’ clients purchased some form of cyber coverage, compared to 33% in the fall 2018 report. Of those clients that purchased cyber coverage, 47% of respondents increased their coverage levels. This falls in line with The Council’s Quarterly Property/Casualty Market Report, where 74% of respondents noted an increase in demand for cyber insurance.

More Market Trends

- 42% of respondents’ clients purchased at least some form of cyber coverage

- 23% of those clients who purchased cyber insurance, 23% were first-time buyers

- 47% of respondents’ clients increased their coverage levels within the past six months

- 75% of those with cyber insurance have standalone policies

Pricing Trends

- $2.0 M was the typical cyber insurance policy limit

- 82% of respondents said premium prices either stayed the same or decreased over the last six months

Underwriting

- 53% of respondents did not see any tightening of carrier underwriting practices in the last six months

- 77% of respondents believed there was adequate or somewhat adequate clarity as to what is included and excluded in a cyber policy

- 86% of respondents noted that capacity in the market is either plentiful or increasing

Cybersecurity/Cyber Risk

- 88% of respondents’ firms have a strategic approach to marketing and educating clients about cyber risks

- 38% of respondents’ clients have an information security program in place focused on prevention, detection, containment and response

Another interesting trend from the results was several broker respondents noting interest in utilizing tech-enabled MGAs, such as Coalition, Corvus or EvolveMGA, in order to place small-business cyber coverage. While a number of respondents are already placing cyber through tech-enabled MGAs, others remained with established market players, particularly to place larger risks.

Additionally, “post-breach resources” has started to become a big motivator for the purchase of cyber insurance: 28% of respondents said large entities purchased cyber insurance for that reason, compared to the just 11% of respondents who said the same in the last survey. “They’re [respondents’ clients] starting to see REAL losses and the fallout,” explained one respondent from a large Midwestern firm. However, risk transfer remained, reasonably enough, the overall main reason for the purchase of cyber insurance.