The pandemic has changed some of the ways that most industries, including insurers and their customers, operate.

The contagious disease has led many insurance professionals to work from home and forced many companies to find new ways of doing business. Those changes also caused the private U.S. property/casualty insurance industry surplus to drop by $75.9 billion in the first quarter of 2020—its largest-ever quarterly decline–according to a report by Verisk and the American Property Casualty Insurance Association (APCIA).

Since the first quarter, however, the Dow Jones Industrial Average (INDU) and the S&P 500 (SPX), which track the largest publicly traded companies and are usually considered the leading U.S. economy indicators, have fully recovered from the march drop. Instead, the STOXX Europe 600 Insurance Index (SXIP) and the S&P 500 Insurance Index, which track the performance of insurance companies in Europe and the U.S. respectively, show that insurance companies have only recovered half of their original market value from the market crash of early February.

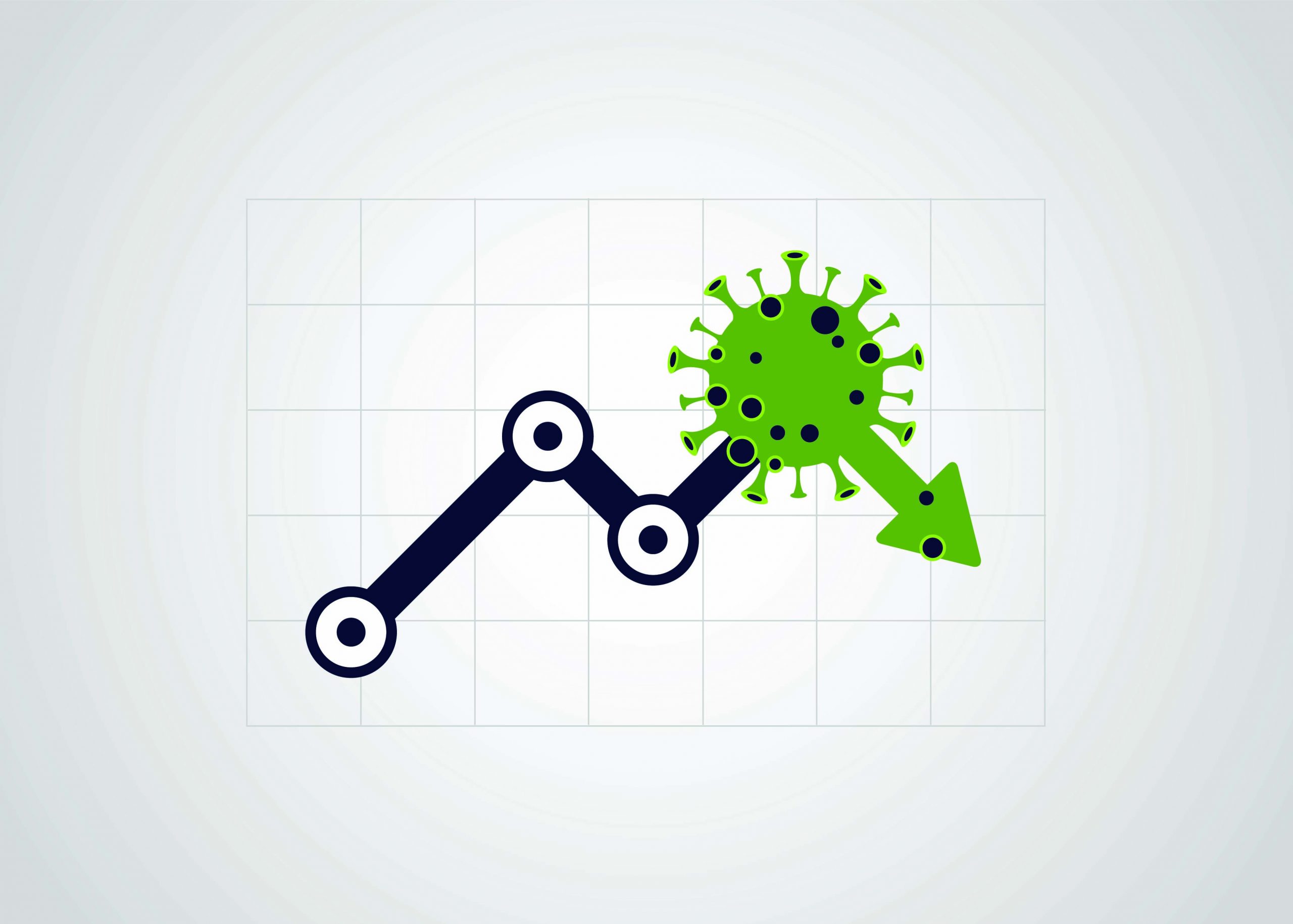

Earnings: Brokers

On the broker front, many showed positive results with revenues and net incomes slightly below par when compared to the 2019 Q2 results. Operating margins were also highly impacted by the pandemic as brokers (and many companies in all industries) rushed to cut discretionary expenses, such as travel and entertainment costs, to maintain the appropriate liquidity levels. On a positive note, the financial services industry stands out with the lowest unemployment rate in the U.S. by industry after insurers pledged to avoid layoffs during the pandemic health crisis.

“We could cut our expenses significantly from here and deliver margin improvement in the back half of the year even if our top line is negative, but it would not be good for the company in any type of mid-term or long-term perspective. So, we’re not going to do that,” said Marsh CEO, Dan Glaser.

On the M&A front, the latest Hales Report provides an in-depth analysis of the supportive conditions and trends which may lead to elevated M&A activity for the remainder of the year. In fact, according to the report, there is strong demand for M&A deals as larger buyers are focusing on long-term strategies and smaller agencies may be facing financial pressures. Favorable tax conditions and the ability to borrow money at low rates, as the Federal Reserve expects to maintain near-zero interest rates until 2022, also make the M&A market very appetizing.

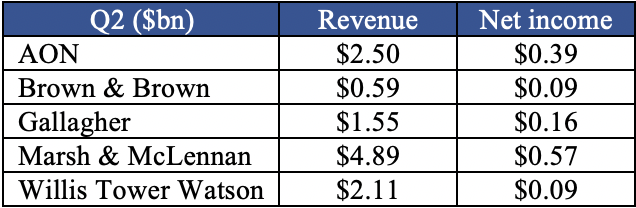

Earnings: Carriers

Carriers have shown less resiliency to the effects of the global pandemic, as many saw their net incomes reduced drastically while maintaining steady revenues This is due to larger than expected catastrophe losses which include COVID-19, civil unrest and severe weather-related events.

“Notwithstanding our second quarter results being impacted by considerable catastrophe losses from COVID-19 as well as civil unrest and weather-related events, our underlying combined ratio improved year over year,” said Dino Robusto, CEO of CNA.

An example of the vast effects of the pandemic on earnings can be seen in AIG. The insurance carrier saw net premiums written decrease to $8.5 billion (-2.07%) while posting a net income loss of $7.7 billionn, a 658% decrease from the previous year. However, the carrier maintains solid fundamentals and its CEO continues to focus on long-term strategies.

“We are effectively navigating the current complex environment due to the strong foundation we built over the last three years. […] While unprecedented and on-going, COVID-19 remains an earning, not a capital, event for AIG,” said Brian Duperreault.

COVID-19 Loss Tracker

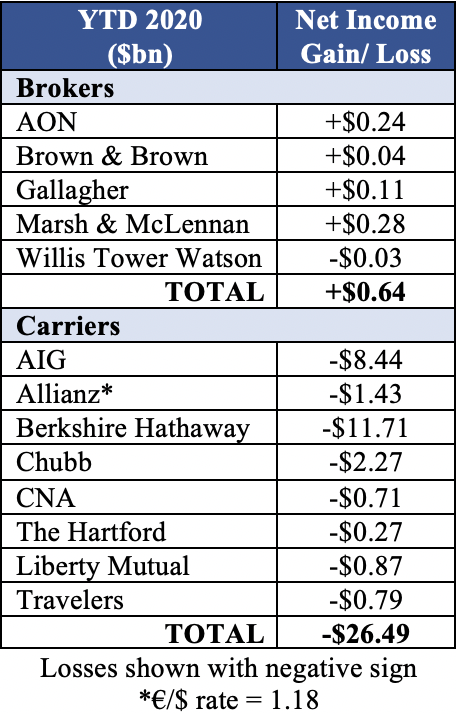

In order to better understand the effects of the global pandemic on the insurance industry during 2020, The Council has developed a COVID-19 Loss Tracker for the insurance broker and carrier sectors. The tracker analyzes the pandemic insurance loss tally by comparing companies’ net incomes from 2020 (COVID-related) and 2019 (pre-COVID). As shown below, insurance brokers have managed to increase their profits by $0.64 billion despite the continued difficulties in doing business. Brokers’ resilience may be due to being less exposed to catastrophe losses and increasing commercial rates; however, brokers may experience an increase in litigation costs over pandemic coverage. Contrarily, insurance carriers saw their earnings decrease by $26.49 billion compared to the first half of 2019, mostly led by massive losses from Berkshire Hathaway and AIG. Carriers, compared to brokers, are more exposed to the ongoing catastrophe losses (COVID-19, hurricane, civil unrest) and to the decrease in demand from the most pandemic affected industries (such as travel and hospitality).

Overall, there is a much more positive view for the remainder of fiscal year 2020 compared to earlier this year due to internal and external industry factors. Internally, the insurance industry is in much better shape when it comes to financials and liquidity; meaning that companies are not only solvent enough to survive the pandemic, but also to continue with large M&A activities. Externally, the situation continues to change given the increasing number of COVID cases, but insurers are not expecting drastic scenarios.

“[AON] continues to prepare for a broad range of economic scenarios, but we believe the probabilities of absolute worst-case scenarios assessed in early March have diminished,” Aon CEO, Greg Case explained.