Panic! In the Courtroom

Five-year-old Zubida Byrom could be facing a lifetime of expensive medical treatments after suffering brain damage during her birth at Johns Hopkins Bayview Medical Center.

The money for her treatment will be there, but it comes at a staggering cost to Johns Hopkins. Last July, Zubida’s mother, Erica Byrom, won a $229.6 million settlement after filing a lawsuit accusing Johns Hopkins of medical negligence. She blames the hospital for her daughter’s brain damage.

By all accounts, providing a lifetime of daily necessities and medical treatment to Byrom, who is otherwise healthy, will be extremely expensive.

Last year many insurance carriers’ third-quarter earnings reports contained mention of social inflation.

Settlement statistics show a steady rise in the largest U.S. verdicts from 2014 to 2018.

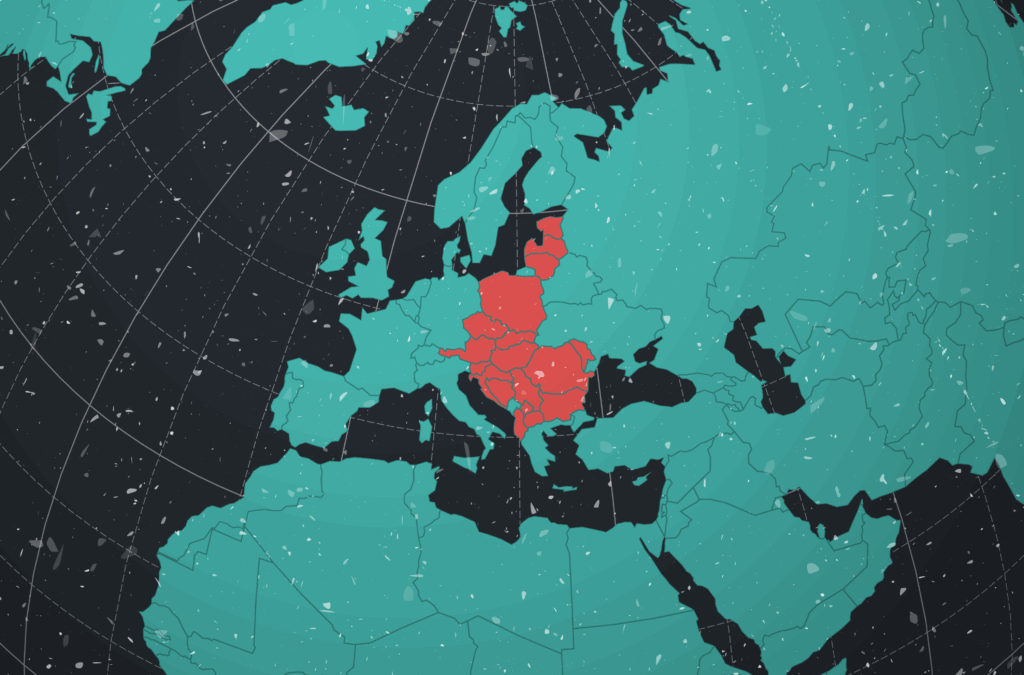

Many experts contend social inflation is spreading in a manner that is difficult to predict.

Take a further dive into the causes of social inflation and the worst court jurisdictions.

“Cases like this, if successful, will always result in large amounts because they will account for the needs of a child living 70 years with a devastating injury,” says Mary Koch, the attorney who represented the Byroms in their lawsuit. “It takes a lot of money to take care of a child over that period and put that child back in the same place as if the injury had not occurred.”

Yet the measure of $200 million in future medical damages was nearly five times the $42 million maximum estimate of a life planner who testified on behalf of Byrom. Many observers say the case, currently on appeal, provides yet another example of social inflation, of jurors in liability trials granting ever larger awards. Components of the $229.6 million included $200 million future medical, $3.6 million past medical, $1.02 million in lost wages, and $25 million in pain and suffering, which under state law will automatically be reduced.

Koch says the jury might have awarded such steep medical damages because evidence presented in the trial demonstrated how the cost of care can vary greatly over the longer term. The high inflation rates of the 1970s, for example, would have dramatically increased costs under the model used. Koch says Byrom’s care needs will be extensive, including a 24-hour licensed practical nurse care to maintain her feeding tube, a special vehicle to transport her, a handicap-accessible home, special showers, a bed, wheelchairs, occupational therapy and speech therapy.

“We are disappointed with the judge’s ruling and will be appealing,” says Liz Vandendriessche, a spokeswoman at Johns Hopkins Medicine who declined to discuss the medical provider’s insurance arrangements. “Cases like these are tragic, and our hearts go out to this child and the people who are caring for her. However, while federal privacy laws limit our ability to discuss the details of a specific case, we are confident in the care this patient received. In addition, the jury’s award in this case far exceeds what even the plaintiff was seeking. There should be a better solution in the state of Maryland to meet the medical needs of children in these tragic circumstances. If that does not happen, the number of Maryland physicians and hospitals able to take the risk of caring for OB patients will likely decrease.”

After a long period of dormancy, many insurance experts say a trend toward social inflation verdicts over the past several years is rapidly ratcheting up liability costs and helping accelerate a hardening insurance market with higher rates, lower limits, tighter policy terms and conditions, and, in some cases, reduced availability of coverage. Last year many insurance carriers’ third-quarter earnings reports mentioned social inflation and its deleterious impact upon margins.

“We are experiencing what appears to be a fundamental and systemic change in liability losses—and not for the better,” writes Joseph Peiser, global head of broking at Willis Towers Watson, in a recent report he authored, Insurance Marketplace Realities 2020. “Loss severity in auto and general liability, and therefore umbrella, is spiking due in large part to so-called social inflation.”

Social inflation refers to the tendency of jurors to award higher sums over time for successful tort liability claims, which in turn ratchets up plaintiffs’ expectations of generous settlements. The severity of settlements differs from state to state, but across the country it’s increasing almost everywhere, says Rob Francis, executive vice president for underwriting and operations of ProAssurance Corp., in Birmingham, Alabama, which specializes in professional liability insurance for healthcare providers. “I don’t think there is any question that social inflation is a real phenomenon,” Francis says. “Most companies are definitely seeing higher trend rates in their data, causing reinsurance products to be exposed at higher limits, in the $5 million to $25 million loss range. Large payouts are remembered by potential jurors and by plaintiffs, and they act to backstop plaintiffs when matters go to trial.”

Thomas Holzheu, chief economist for the Americas at Swiss Re, says, “There is more professional representation of plaintiffs, longer duration of claims, often leading to larger settlements, and large claims are getting larger at a more rapid pace. Lawyers are using more advertising, have more knowledge of social media, and are using claims data more effectively. They are also specializing in different areas of liability, such as commercial trucking. They know what to look for, how to look for evidence. There is more professionalism and data analysis. When large verdicts occur, they result in benchmarking of other claims that settle at that price.”

Specific Lines Affected

Settlement statistics show a spike in 2018 in the largest U.S. verdicts, and there have been recent increases in premiums for D&O, umbrella, average commercial lines, medical malpractice, and commercial auto. While only a portion of these rate increases may be caused by social inflation, all of those lines are ones in which social inflation has been named as a leading contributing influence.

Commercial auto, long a money-losing segment for much of the industry, may have the dubious distinction of being the leader of social inflation impacts, Holzheu says.

But D&O insurance is another line that has been hit hard with hefty settlements. “Generally, across the board, we are seeing a significant increase in litigation resulting from D&O claims,” says Michele Comtois, a principal in the executive liability practice at Marsh & McLennan Agency. “The median settlement amount for D&O claims from 2017 to 2018 increased due to higher settlements and fewer small settlements.”

Medical malpractice is also seeing increases in verdict severity. “By almost every measure, medical malpractice verdict severity increased to record levels in 2018,” says Richard Henderson, senior vice president of TransRe. “This included verdicts as measured by the average of the 50 largest verdicts, verdicts of $25 million or greater, verdicts of $10 million or greater, 10th largest verdict, 25th largest verdict and 50th largest verdict. This suggests that it is not just the handful of ‘nuclear’ verdicts where there was an increase but that there was an increase which extended much deeper than just the ‘headline’ verdicts.”

Henderson also notes that record verdicts are even being returned in historically defense-friendly venues where plaintiff verdicts have been rare. He says the phenomenon has caused a ripple effect in that “many decision makers on the defense/insurer side have become increasingly risk averse when it comes to trying certain claims, particularly in some of the venues where huge verdicts are being returned.”

According to David Perez, executive vice president and chief underwriting officer, North America, at Liberty Mutual Group, “Any exposure, whether class-based or individual risk-based, that has any elements that resonate with a jury is problematic. In those cases, there is more of a juror sense of wanting to do what is right for the victim rather than follow what the law is. Thus, for example, if a claim comes in that involves a badly burned child, even if a corporate defendant has no liability, the jury believes there has been an injury to an innocent child and the corporation should pay. It is hard to stay focused on facts.”

Plus, many experts say social inflation is now spreading more widely to other lines prone to liability lawsuits in a manner that is difficult to predict. Statistics from Swiss Re demonstrate these increases across six different insurance lines.

“Professional liability insurers are more frequently challenged by claims arising from a wider range of incidents that previously related to other business segments,” notes James Auden, managing director at Fitch Ratings. “Events that lead to employment practices liability insurance, product liability or cyber liability claims are more likely to also trigger a D&O claim from allegations of poor oversight and governance practices by management and board members,” Auden says.

Many experts say social inflation is expected to increase for at least the near future. “We expect this to become an increasingly common theme in the coming year or two, with the impact spreading across more lines of business and inflicting financial stress on affected insurers,” Holzheu noted in a recent report.

Limited Limits

In addition to rising deductibles and retentions, limits are being reduced. The net effect is that brokers and agents will have to work harder to find coverage for their clients.

“Virtually any organization is finding it hard to find more than $10 [million] or $20 million in coverage from any one insurer,” Peiser says. “In particular, we are seeing a significant tightening in the market for any coverage involving childcare, schools or sports. It’s not impossible, but it’s much more difficult. We are seeing lead umbrella insurers only offering limits of $5 [million] or $10 million, compared to $25 million three years ago. Insurers are saying the verdicts are so unpredictable that they are unsure where losses might come from and they don’t want to take on any type of risk.”

Francis, of ProAssurance, says social inflation has affected underwriting practices. “We have changed our willingness to offer excess limits, and we will be more cautious in some venues and for certain policyholders and will charge more,” he says.

Even so, insurance companies may find themselves exposed to claims in excess of their contractual limits, Francis says. “If it goes to trial, the tort laws are unfriendly to insurance companies. The insurance company must show that they were reasonable in not settling a case for under $1 million, which is difficult to prove. If they cannot prove that, the insurance carrier might be liable for more.”

To date, coverage can be obtained for most lines affected by social inflation by stacking more levels of smaller increments of coverage, Peiser says. “Programs are involving many more insurers than in the past,” Peiser says. “For example, a D&O program can still be insured for $100 million or more, but you may need 10 to 15 insurers instead of five or six due to reduced risk tolerance. Liability insurers are demonstrating discipline by raising rates and are hedging their bets by deploying much lower limits on any one risk.”

MMA’s Comtois says some insurers impose restrictions in coverage and look for companies to take on higher retentions, which, she says, “cause a big portion of the claim to be self-insured before coverage kicks in—as much as $5 million to $10 million.”

Client Conversations

Brokers need to understand social inflation and be able to effectively explain to insureds its effect on rates and that insurers are not seeking to bilk them, many of those interviewed emphasize. It’s important for such conversations to take place as soon as possible.

“Currently, we have clients who, for a decade or more, have been experiencing price declines who are now facing dramatic increases, and they are not used to that,” Peiser says. “They challenge whether the increase is really warranted and warranted in their area. They point to the high capitalization of the insurance industry and ask why they need rate increases. Generally, if the carriers need to increase their premiums, we as brokers should try to influence them to increase rates gradually. But that is not working now; the carriers say they need rate increases now. We need to communicate that the cost trends do show they need those rate increases.”

Francis says agents and brokers need to get in front of renewals when anticipating higher rates from carriers and explain to clients the trends in a given line as well as in each client’s state. He points to the historically low professional medical liability rates that finally need to go up due to the increasing severity of claims. “We need to communicate the history of the rates,” Francis says, “so they can see they have been getting fair value over that time.”

Liberty Mutual’s Perez emphasizes considering the impact of the news and how it will traverse through an organization’s leadership. He also points out the importance of fostering and relying upon good relationships in difficult times. “Customers have to decide who their partners are, including with insurers,” Perez says. “If one carrier is three or four times the cost of another, that decision for a customer is easy, but if it is closer, we recommend they stick with the carrier that knows their business the best and with which they have a strong relationship.”

Creativity is also part of the solution that brokers and insurers must build together for their clients, Perez says. “If we cannot offer something they want the way they want it, we should explore whether there is a good alternative. For example, if we would normally exclude a risk due to auto fleet exposure, in underwriting them we might quote a bigger retention or exclude drivers or not cover auto or exclude certain types of vehicles. There are often ways to carve out the problem.”

Brokers and agents need to use their size and sophistication to advocate for insureds, says Comtois. “We use analytics to negotiate favorable coverage and terms for our clients,” she says. “We are a large broker with a broad client base, and as a result we can leverage our extensive claims experience to ensure our clients get the best renewal results. There are various ways to structure a D&O program depending on available insurers and coverage alternatives in the market. For example, a D&O program for a public company includes liability coverage for the company and its directors and officers. Some companies may allocate a larger proportion of coverage to individual directors and officers, as opposed to corporate liability coverage, in their overall program as a more economical way of insuring against liability claims.”

Playing up the policyholder’s claims history—if it’s favorable—is a common strategy.

“What we have done more often when speaking to insurers is argue that the client’s claim history should be weighted more significantly or more fairly when pricing is determined by the carrier, rather than based on geography, which has received increased weighting,” says Kevin Carnell, chief operating officer and general counsel at Baltimore-based insurance advisory firm RCM&D.

Richard Betterley, an insurance industry consultant, says brokers and agents who do not adapt are vulnerable to competitors who offer better coverage or risk management techniques. “If I were a broker and had to go to a client and say, ‘You have leadership or owners that are targets, and your insurance company doesn’t want them,’ I’d hate to make that argument and not have a solution for them,” Betterley says.

Still, in switching insurers and adding new ones, brokers and agents must exercise care, particularly with those new to a particular business, Peiser says. “While brokers and agents must leave no stone unturned, they must try to determine if an insurer is committed to that market,” he says. “Will they stay in it? You don’t want to put a band-aid on the problem now, only to create a much worse problem later if they cancel insurance. We must look at the commitment to the business and the financial security of the company. The good news is that, unlike past hard market cycles, the capitalization of the industry is strong. In the 1980s hard market, you heard of insurance companies going insolvent on a weekly basis. You don’t hear about that today.”

The Shift to Excess Lines

Many experts note the use of specialty and surplus lines insurers is increasing as a result of social inflation.

“Some shifts that are occurring due to social inflation include risks moved out of standard coverage as a result of the claims,” Holzheu says. “Meanwhile, a rising share of business is shifting from the admitted market to the excess and surplus market and to facultative reinsurance. That is because some players may not have expertise, as they do not experience as many claims to have the expertise or actuaries to price risks, or because they just have a reduced appetite. That is why rates go up—there is a spreading around of the uncertainty. Brokers will need to manage this and accommodate shift of the placement. There is work involved for them to be aware of that coverage, and it can be more difficult to put a price on these risks and claims.”

Specialty insurers have arisen in the past due to increased litigation. In the 1970s, California experienced a wave of malpractice lawsuits and jury awards. This led to exponential increases in malpractice insurance rates. Some physicians faced non-renewals from their insurers. To combat this trend, California passed major tort reform legislation. At the same time, several new physician-led malpractice insurance companies were formed.

One was the Doctors Company, a midsize insurer with assets of $6 billion and a policyholder surplus of $2.2 billion. “Over the last few years, some mainstream companies moved their capital out of professional liability and healthcare liability into other areas,” says Bill Fleming, chief operating officer at Doctors. “Essentially, social inflation is chasing them out of the market. Social inflation and other market conditions have combined to cause carriers that were not as disciplined as necessary to pull back. In contrast, we endeavor to charge appropriate rates and terms for all market conditions, whether in 2012 or 2020.”

Fleming says specialization allows the organization to better manage risk. “Our coverage is tailored exactly to healthcare professional and organization needs,” Fleming says. “We don’t have to write forms for all possible industries.”

Differentiating Risk

The wild card of social inflation has focused the attention of carriers, brokers and agents on identifying, minimizing and better quantifying risks whenever possible. Thus, says Perez, the scrutiny of policyholder risks has increased. “Services that come with some brokerages and agents and insurers were never as important as now,” Perez says. “One mistake made by a carrier for an insured can result in a terrible verdict by missing something that could have been addressed through risk control or through claims discovery.”

“There is increased scrutiny by insurers on safety tactics,” Peiser says. “While you can’t be 100% safe, they are looking at driver safety, training, and use of telematics. The hotel and resort industry is paying more attention to fire safety precautions. I wouldn’t say they had gotten lax, but due to an abundance of capacity up until recently, they didn’t ask as many questions. We are advising our clients to catalog all safety precautions and step them up. Once there is an injury, it is a roll of the dice as to the value, so the best thing to do is to cut down the number of injuries.”

Analytics is transforming many areas of insurance, and coping with litigation risk is no exception. Unlike past cycles, current premium increases are varying dramatically by company. For example, it wouldn’t be unusual to see 7.5% increases for well managed risks but more than 100% price spikes for insureds with poor risk control and/or large losses, Peiser says. “The reason for that is the growth of analytics,” he says. “There are more and more ways to differentiate the good risks from the bad risks. It is used by both underwriters and brokers. For general liability, we can compare specific client losses to experience in the general industry. Brokers can use analytics to argue carriers’ rates are too high, but sometimes those analytics show vulnerabilities of the insureds. It is very granular. Using that type of data, the broad brush of conservative underwriting can be ameliorated. What is important is that the analytics be sound, because otherwise the insurers dismiss them. We have had our analytical models built by actuaries, and we talk to insurers’ actuaries to make sure we are not painting rosy pictures and that we are using the right approach.”

Some of the risk factors that relate to juror behavior are becoming more apparent, according to some experts. “For EPLI and D&O insurance, for example, having a celebrity-type leader who is a household name who can be named as a potential defendant can make a difference,” Betterley, of Betterley Risk Consultants, says. “Insurance companies are more cautious about these types of insureds.”

D&O plaintiffs have gravitated toward companies with large valuations, Comtois says. “Tech unicorns with stock volatility have been easy targets,” she notes.

Once a Claim Commences

There is much that brokers and agents can do to mitigate risks once a claim commences, Peiser says. Good claims handling can help ensure insurers and insureds remain in alignment, he notes, specifically citing the importance of avoiding litigation between the policyholder and insurer over whether a claim is covered due to compliance (or lack of compliance) with policy provisions. “We need to work diligently to make sure they are in compliance,” Peiser says. “Sometimes claims can take years to complete. If there is not proper communication between the insured and the insurer, the insured can find itself in breach.”

Comtois says policy coverage challenges often arise during D&O litigation. “Policies can be written in black-and-white terms, yet the interpretation of policy language often differs from underwriting intent….” she says. “The devil is in the details, and as agents and brokers, we need to be on top of that.”

In this litigious market, Perez says, speed is of the essence. “You have to get an investigation done very quickly today. You don’t want to be surprised by the malfeasance or bad background of insureds. If the insured disregards safety procedures, it is not perceived well. If there is a chance to dispose of it, you dispose of it quickly. There are concerns in the industry that we are reacting too quickly to particular claims, but it is better for our customers to get out of tough cases quicker and sooner.”

And the enormous sums at play do increase the danger of insurer-versus-insured lawsuits. In 2017, Walmart paid a large sum, estimated by some at more than $90 million, to settle claims after one of its trucks hit and seriously injured comedian Tracy Morgan and killed another comedian, James McNair. Its insurer initially declined to reimburse Walmart for the settlement, so Walmart sued. The two came to a negotiated settlement.

Insurance defense attorney John Hall, partner at Atlanta-based insurance defense firm Hall Booth Smith, says in high-dollar-exposure but highly defendable cases, insureds and insurers should carefully prepare their own estimate of reasonable settlements, not just be responsive to estimates by plaintiff’s counsel, and should consider litigating when appropriate.

“For certain matters, in order to not encourage lawyers to fund more unwarranted lawsuits, it is important for all the insurers in the chain, insureds and brokers to communicate with each other and, when warranted, to stand their ground and to be willing to proceed to trial,” says Hall, who notes that only about 3% of lawsuits proceed to trial nationally. “That includes the person with the lowest exposure, who may have the incentive to settle. It should not be reflexive that you have to settle a case.”

Brokers’ role in litigation is to advise clients as to whether to consider settlements and how to structure them, Peiser says. “We don’t say how to settle this particular matter, but we may say here are techniques other insureds have used in the past.” One such technique, Peiser says, is a high/low approach, in which plaintiffs and defendants agree to allow recovery of a minimum amount, but no more than a maximum, when a case goes to trial.

Hall says, “Agents and brokers are going through and identifying cases, getting reports on certain higher-risk cases, sitting with insurers when the companies and the insurance companies talk strategy, and having input on the strategy that is adopted. When there is a settlement decision in a larger case, you will see brokers participate in the conversation. They add value, as they have a different perspective from the other players, including regarding the ability to place coverage in the future and wanting to protect the reputations of insureds.”

There is some potential liability for brokers and agents, too, Hall says. “There is potential liability for them if they placed inadequate coverage or didn’t give good advice on a reasonable level of coverage or type of coverage needed,” he says. “And they should make sure they placed coverage with a stable carrier.”

Tort Reform

Many say the ultimate answer may be tort reform. Similar escalating liability case trends brought a wave of tort reform in the past. However, such laws have been undermined in many jurisdictions, including through some court decisions that have thrown out or limited some or all tort reform components. Of the last wave of tort reform state legislation in 2005-2006, most laws have been overturned, including in Illinois, Georgia and Florida, Hall notes. More recently, a state limit on tort claims was struck down in Kansas in 2019.

Hall contends there is considerable work for such legislation to pass in the current environment. “Companies and the insurance industry are not unified at the state level to fund efforts for tort reform,” Hall says. “Companies get caught up in other regulatory reforms, and tort reforms end up being not as central. We need tort reform at the state level soon. Otherwise the system could collapse, the market will become harder and harder, and eventually there will be a challenge to the jury trial system, which I believe is a fundamental Constitutional right.”

Francis notes that tort reform in individual states “doesn’t happen” until those involved reach a consensus that a problem exists. “There was a crisis in Texas with losses going up and with physicians saying, ‘We can’t practice here anymore,’” he says. “The availability of healthcare drives reactions. In 2003, Texas passed a cap on non-economic damages at $250,000, which is where it is today.”

But every market is different, and many are not in crisis, which only complicates the messaging efforts. That could change, Francis notes.

Holzheu suggests including legislation to make the financial interests of plaintiff’s attorneys transparent to the jury. “Do juries know that an award may not go to the victim if he or she has sold off his or her claim?” Holzheu says. “They have been paid for their interest, and recoveries will go to litigation investors.” Another litigation provision has been to allow state claims to be transferred into federal courts, which are generally seen as friendlier venues for corporate defenders than state courts, Holzheu adds.

If costs are not contained, one scenario is the imposition of a no-fault mandatory liability regime similar to that of workers compensation. Under one such variant, already in place in some states, doctors, hospitals and insurers pay into a state fund to cover certain types of liability, such as children suffering brain damage at birth. Koch, the plaintiff’s attorney in the Byrom case, notes that Virginia and Florida have such funds, though the Virginia fund is almost bankrupt.

Even larger litigation challenges may await, Perez says. Opioid litigation is already under way and has led to large settlements. And some state legislatures are considering bills that would extend or suspend statutes of limitations for certain claims, such as sexual abuse allegations. Such legislation, of course, could lead to even more expensive litigation.

While not solely due to social inflation, insurance rates are rising—and quickly—reflecting rising reserve and loss cost trends. Joseph Peiser, global head of broking at Willis Towers Watson, says that, while such rates differ by line, the 2020 insurance budget of the average large corporation will increase by 20% from a year ago. By line, that number can vary, with D&O increasing by as much as 30%; property risk with high catastrophic exposures likely increasing 25% to 30%; and umbrella growing as much as 30% to 35%. Workers compensation rates are a silver lining, as they are remaining stable, Peiser says.

In its quarterly survey of commercial P&C brokers, The Council found an increasing number of brokers characterize the market as transitioning from firm to hard; premium pricing across all account sizes increased 6.2% in third quarter 2019, marking the eighth consecutive quarter of rate increases.

Umbrella and commercial auto were hit hardest in the third quarter, with average price increases of 9.8% and 9.1%, respectively. The average premium increase across all major lines was 5.9%, compared to 4.6% in second quarter 2019 and 3.4% in the first quarter, according to a CIAB Commercial Property/Casualty Market Index Report.

Litigation trends and nuclear verdicts were among the causes proposed by survey respondents for the increases.