In Flux

Since the bull market in insurance brokerage M&A began over a decade ago, the burning question has been, “When will the party end?”

With some of 2023 now under our belts, we see significant shifts occurring in the marketplace. Is the consolidation frenzy and valuation explosion ending? Industry leaders would be wise to consider the words of College Gameday broadcaster Lee Corso carefully, “Not so fast, my friend.”

Economic uncertainty and higher cost of capital is making buyers much more discerning.

Firms with less cash to lay out will focus more on organic growth than acquisitions.

Despite challenges, brokerage valuations continued to grow through the beginning of the year.

The insurance brokerage M&A space, for both buyers and sellers, is changing dramatically. We see a new bifurcation playing out in real time, resulting in haves and have-nots. Let’s begin with the market today and then tackle where we’re likely heading.

M&A by the Numbers

Deal volume is down. On average, 609 transactions have been announced annually for the past decade. Even though 2022’s 639 deal total was above this average, it did represent a 35% decrease from 2021. (Editor’s note: deal totals are calculated internally by firms and may not align across all writers in this issue.) Not surprisingly, a substantial majority of completed transactions continue to involve buyers backed by private equity.

Several factors contributed to the downturn in 2022. In 2021, many sellers rushed to market to avoid President Biden’s proposed increase in capital gains tax rates. Many deals that might have occurred in 2022 were accelerated into 2021 in a proactive move to beat the tax man.

The other cause for the deal drop-off in 2022 is also tied to national policy, this time in the form of the Federal Reserve’s increases to the federal funds rate. In March 2022, the Fed began a series of nine increases to the federal funds rate to cool inflation, which hit a 40-year high in June 2022.

The federal funds rate is the interest rate at which the Fed lends money to financial institutions, which, in turn, lend the money to consumers and businesses. These interest rate increases restrict the money supply, tempering demand for goods and services, thus reducing inflation—or that’s the theory.

Interestingly, deal activity decreased dramatically at about the same time that the Fed’s rate increases began. The number of transactions announced in the second half of 2022 was down a whopping 44% from the same period in 2021. How are these rate increases affecting M&A activity in our industry, and who, specifically, is feeling the heat?

The Evolving Role of Private Equity

Private equity (PE) is among the industries most acutely affected by interest rate fluctuations. The PE model is simple: raise equity capital and debt to buy companies; use acquired earnings to service debt; grow the companies and improve their marginal profitability; then, after three to seven years, return capital to investors through a sale or other liquidation event.

In a low-interest-rate environment in which acquired companies are growing, PE is a powerful wealth-creation machine. Since the Great Recession, PE investment returns in our industry have routinely been in the 25%-35% range.

During the Great Recession, the Fed cut rates to almost zero in an attempt to stimulate the economy. Then, much to the delight of private equity firms, interest rates never returned to normal, even after the economic crisis was a distant memory. As the federal funds rate and PE total deal chart demonstrates, PE buyers made excellent use of this cheap debt to fuel their M&A engines.

Buy-Side Haves and Have-Nots

Since any increase in interest rates will compress profit margins, all PE buyers are feeling the pain of rate increases—some more than others. Increasingly, two classes of PE buyers are observed in the market: the cash-rich and the cash-poor. The cash-rich are those with ample cash and recently renewed debt facilities. For them, it’s business as usual. For now, anyway. The strongest players in the PE industry have accepted that higher interest rates will compress their investment returns. Still, they play the long game and remain committed to their M&A growth strategies.

At the other end of the spectrum live the cash-poor. By mid-year 2022, these PE players found themselves with diminished cash positions, compressed cash flows, and no way to raise new, cheap debt to replenish their coffers. These firms have moved into cash preservation mode to fund operations, service debt, and fulfill seller earnout obligations. Their orientation is now largely internal, focusing on integrating acquired assets and improving operations.

As has been widely reported, several of the most acquisitive PE buyers in the marketplace have discontinued M&A activity for now or are much more selective in what opportunities they pursue. There have been several instances of PE buyers pulling deals off the table at the 11th hour, virtually unheard of in this industry.

Stay tuned to see what impact continued rate increases might have. Well positioned PE firms will still have to raise additional capital at some point to keep their acquisition ships at sea. What will happen to even the best-positioned PE players if the cost of capital remains high or pushes even higher?

One frequently cited solution would be for PE firms to go public to access the capital they need to fund future acquisitions. The timing for this would appear challenging, as the IPO market has seen better days. After a record-breaking 2021, S&P Global reports, IPO activity worldwide was cut nearly in half in 2022. Going public may likely be easier said than done in 2023.

For now, the clear winners on the buy side are large, well-positioned PE and public brokerages yet to feel the pinch of the ongoing interest rate drama. Transactions are increasingly flowing to this well-capitalized subset of the buyer universe, who can move decisively to get deals done.

Valuations

With fewer insurance brokerage transactions and a sizeable number of buyers on the sideline, common sense and a basic understanding of supply and demand would dictate that brokerage valuations should moderate or even decline. The current data, thus far, tell a different story.

The good news for sellers is that record valuations continued during 2022 and into 2023. In evaluating our 2022-2023 deal activity, valuations, measured as a multiple of EBITDA, have continued to increase.

Keep in mind, though, that this is historical data. The 2022-2023 transactions cited above were closed or negotiated before the worst interest rate drama saturated the market.

This good news regarding brokerage valuations is not confined to modestly sized brokerages. Hub International is rumored to be working to secure a minority investor at the highest private-brokerage valuation in the industry’s history. Truist Insurance (formerly BB&T) recently completed a minority interest sale to Stone Point Capital at a reported 17.2x its 2022 EBITDA. The market continues to be kind to high-performing brokerages.

Sell-Side Haves and Have-Nots

Going forward, record valuations and maximum marketability will be the sole domain of high-quality brokerages. As with the PE buyers, the sellers market has haves and have-nots. The “haves” demonstrate highly desirable characteristics: strong leadership, high growth, solid profitability, attractive geographies, specialization, and a young group of employees.

Those who do not have these characteristics are likely to experience very different valuation results. For the brokerage “have-nots,” frequently small, tired and with limited growth potential, the ability to sell quickly at a high valuation has likely passed. For years, a selling brokerage couldn’t swing a dead cat without hitting a handful of eager buyers willing to pay top dollar. This is not so true today.

Where does this leave us as we move forward in 2023? Has the market finally peaked? Perhaps, but there is more to the story. As we move through 2023, several other factors must be watched closely.

Public Brokerage Valuations

Public brokerage valuations reached all-time highs in 2021 (18.3x EBITDA) and then began a slow slide, ending 2022 at 16.4x EBITDA, a 10.4% decrease. Organic growth trended down slightly, too. Despite this modest drift downward, public brokerage valuations ended the year well above the historical norms of ~12.5x EBITDA.

These lower public brokerage valuations won’t help private brokerage valuations. Buyers seek to purchase agencies at a discount to their own valuations. If public brokerage valuations decrease, it is reasonable to assume they will eventually reduce the valuation multiples they pay for acquisitions. Otherwise, acquisitions may be dilutive rather than accretive in the short term. Lowering valuations for M&A targets might have been challenging in a super-competitive market with no shortage of hungry buyers. With fewer acquirers in the marketplace, it may be more manageable now.

PE buyers are affected by public brokerage valuation decreases, too. PE firms generally peg their valuations to the public brokerages, less a modest discount. They, too, may need to reduce the multiples they pay for assets to avoid dilution. All things being equal, whether public or PE, lower equity values for buyers will likely put downward pressure on M&A valuations.

During the worst of the Great Recession, when M&A activity and valuations tanked, many agency sellers decided to wait for the storm to pass before going to market. If valuations decline materially, this could happen again, significantly reducing seller supply.

Economic Uncertainty

The COVID-19 recovery for the industry has been nothing short of amazing. The industry has enjoyed record growth and profitability for several years as the country recovered from the massive economic downturn experienced during the pandemic.

Many factors contributed to this unprecedented growth cycle. The hard P&C market, a material contributor to the industry’s recent record growth, is now in its sixth year. Hard P&C markets typically last a handful of years. Might we finally see a soft market soon?

The economy exploded after the COVID-19 downturn. Insurance brokerages benefitted materially from the strength of the economic rebound. Today, inflation and the fears of a recession persist. Silicon Valley Bank, Silvergate and Signature Bank collapsed in March, the largest bank failures since 2008. Then Credit Suisse went under and had to be bought. Are we due for a broad economic downturn in 2023?

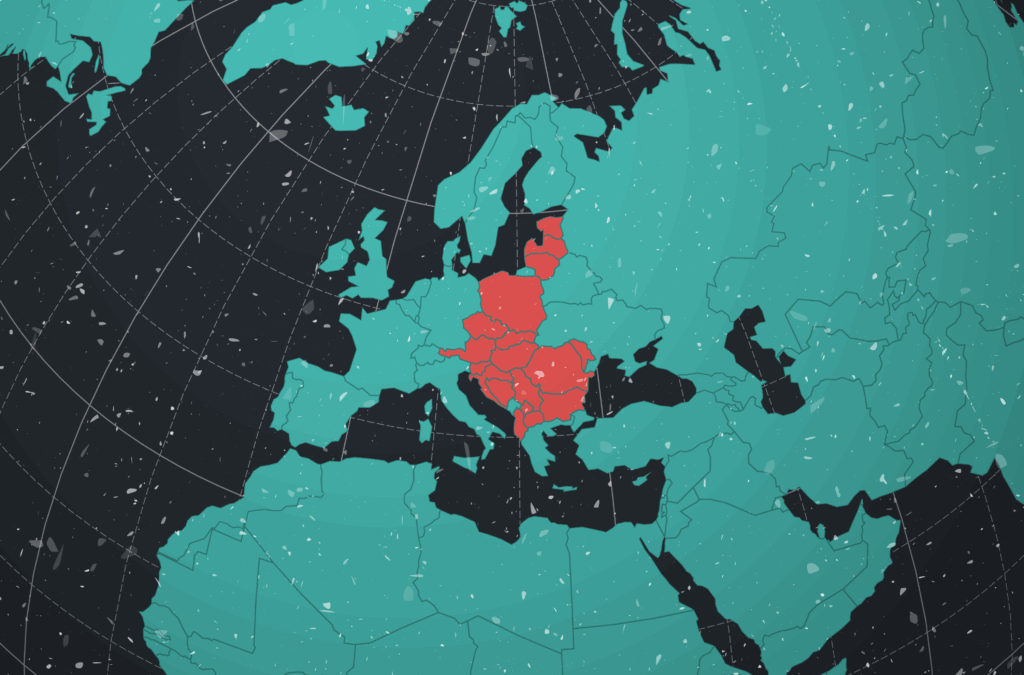

The war in Ukraine rages on. What will the impact on the world’s economy be if things continue to escalate?

We struggle to see how any of these macro factors point to an acceleration in industry performance. At its core, valuation measures an asset’s future growth prospects. Faster growth translates to higher valuations and vice versa. If the above concerns diminish industry growth, valuations will likely decline.

Adapting to the Market

Where does this leave us? What if interest rates remain at current levels? What if public brokerage valuations return to historical norms? What if the economy tanks? What if some of the weaker PE players never recover or they get gobbled up by stronger firms? Will the M&A market come crashing down around us?

This is unlikely. The PE industry did just fine before interest rates plummeted after the Great Recession. PE is a robust financial model that will adapt to new rate realities. The public brokerages are healthy and will remain active in M&A. Private brokerages continue to be active players in the M&A space. Insurance brokerage M&A is likely to stay active but different. Returning to a more “normal” environment would still be healthy.

I once heard a speaker addressing growth in an instructive way. As it turns out, trees generally don’t grow year-round. A tree’s growth is a function of inputs in the form of temperature, sunlight and water. When these inputs are abundant in the spring and summer, a tree will get the bulk of its growing knocked out. When these inputs are in short supply, other vitally important work occurs: the tree grows horizontally to support recent vertical growth. It sheds leaves and needles to protect its branches. It adapts and prepares for the next season. It’s still very healthy overall, just in a different mode.

In this market, cash-rich buyers will continue to focus on vertical growth. Cash-poor buyers will focus on the critical work of horizontal growth. Private brokerages hoping to command top dollar when the time is right will focus on becoming excellent. Excellent brokerages will invariably do fine in any M&A market, valuation-wise, and will have little difficulty attracting a well-capitalized buyer.

A white-hot M&A market and favorable tailwinds allowed many subpar brokerages to sell for incredible multiples. The same market rewarded many buyers who were in the right place at the right time. Today’s market, though, is full of challenges. In the words of the old Smith Barney commercials, if you want to win in this M&A market, you will have to “earn it.”