Fraud Vision

Fraud takes a big bite out of insurers’ profits, and technology makes document fraud increasingly easy.

Many companies still rely on staff to spot fraud with their own eyes. Paris-based startup Finovox uses computer vision to find the fraud before it gets expensive.

In the financial industry, document fraud is the main issue in credits and loans and also in insurance. The two elements are quite different, in credit, loans and factoring, companies are lending or giving money to individuals or other companies and base their ratings on documents. In France it represents a loss of 3% of revenue for these companies. Some of them went into bankruptcy due to fake documents. Urica is a London-based fintech that went bankrupt because they financed a company that did fake invoices.

In insurance, the problem is different because you can create fake documents—if your house burns and you want to send invoices to the insurance companies, you can send fake invoices, you can increase the amount of the invoices, and this represents a big problem for these companies because it’s from 5% to 7% of their revenues. It is an enormous amount of money. They have no tools to detect it. Today they analyze these kinds of documents with the naked eye, so they need tools and information to analyze everything. Today, 7% to 15% of insurance files include fraudulent documents.

In France, there was an 86% increase in fraud between 2020 and 2021, which is huge, and we think that will continue. Just in France, fraud related to documents represents more than €40 billion. Globally, it increases every year because companies don’t have any solutions and it’s very easy to do. According to FiVerity’s Cyber Fraud Network, synthetic identity losses at U.S. financial institutions have reached $20 billion.

The type of insurance that has the most fraud each year is life insurance, with annual losses of nearly $75 billion. Medicare fraud is a close second, costing the federal government approximately $68 billion annually. Workers compensation fraud results in $34 billion in annual losses, much of it concentrated in claims fraud.

We analyze every part of the document. First, we analyze anomalies in the document, if there are variations of the document. When you create a document from invoice software or pay-slip (payroll) software, the documents are always the same, and if you modify it, you change an element on it; the structure of the document will be different; the code of the document will be different. We analyze this code to tell you if there is something that’s not fine and if there are false elements. We also do the same thing with digital analysis.

We analyze the documents using computer vision algorithms, and we can say here the element is not fine because the color black is wrong, because the font is not right, or you have a strange space between words. We analyze everything. We do various analyses on the consistency of the document. If you want to modify a pay slip, you have some elements that have to be normal. We verify that the address works. We verify if the amounts are fine, if the rates are good.

We analyze if the documents come from the dark web or a website that follows you to generate fake documents. We do a very complete analysis in real time. It takes about five to 10 seconds per document, and—after—we give reports to our client and say this document is fine or this document has a higher risk because some of the elements have been changed.

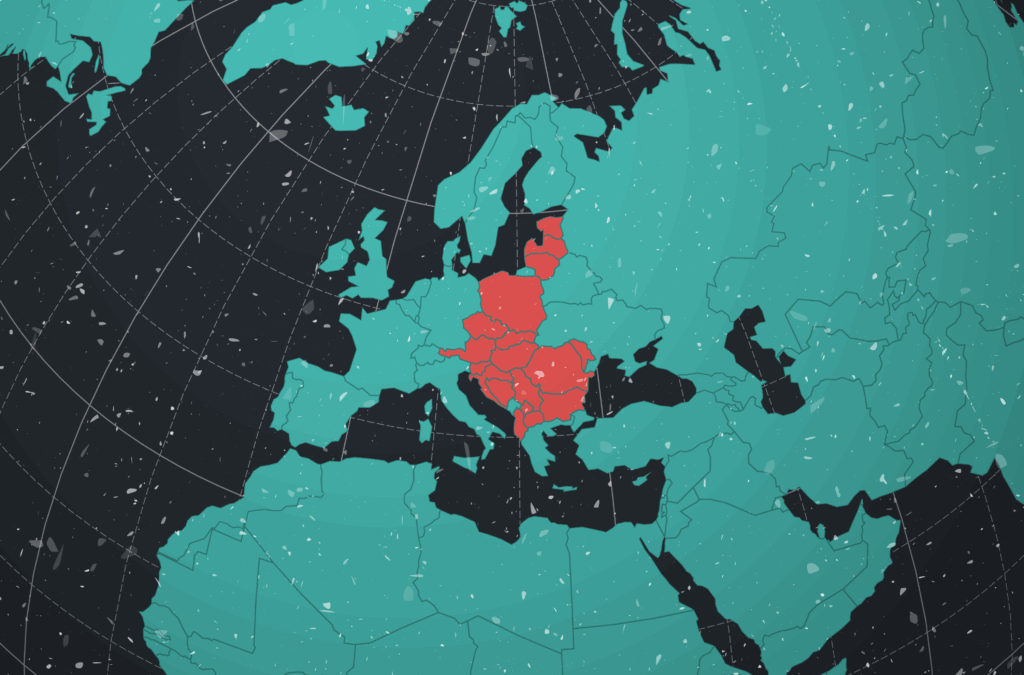

Today we work mainly in France, but we are opening in new countries, for example, French-speaking countries, part of Canada, and Switzerland and Belgium and North Africa. We are also opening in new countries in Europe, like Italy and Spain and maybe Germany. We are thinking about going into the U.S. next year or the year after. First of all, the U.S. market is huge, and it’s a very good economic opportunity for us.

The solution is really applicable in the U.S., which is why we partnered with Sunlight Solutions, which is a cloud-based suite for insurance carriers supporting all insurance products, because they can work with us in the U.S. today. The Finovox solution is applicable to every language in every country. We analyze documents in 200 languages for clients. If the solution is already applicable to every country, we can just expand and scale.