Modeling Shows Drastic Effects of Limiting Tax Exclusion for Employer-Sponsored Insurance

More than half of all Americans receive health coverage through their employer.

Given this, a federal policy change that increases the tax burden for that coverage could have drastic impacts on individual health outcomes and the nation’s economy, according to a new analysis.

Employer-provided insurance became a fixture of U.S. healthcare when wage freezes during World War II made it difficult for employers to attract and retain workers. Instead, they offered health insurance as a form of compensation.

The precursor agency to the Internal Revenue Service determined in 1943 that an employer’s share of employer-provided insurance premiums could be excluded from taxable income. That was codified into law in 1954. The Revenue Act of 1978 then allowed employee contributions to health insurance premiums to be made pretax.

To this day, employer- and employee-paid health insurance premiums are exempt from federal income and payroll taxes. The idea is that this approach lowers most participating workers’ tax bills and their after-tax cost of health insurance. Plus, according to the Congressional Budget Office, this tax exclusion encourages employers to offer health coverage with lower cost-sharing, more covered services, and broader provider networks.

On behalf of the Council of Insurance Agents & Brokers and the American Benefits Council, Ernst & Young modeled the effects of limiting the tax exclusion for employment-based health insurance to the 75th percentile of premiums—some policy circles have floated this approach for changing the current tax treatment amid discussions on options for balancing the federal budget.

Rapidly rising healthcare costs represent a fundamental economic challenge fueled by inflation, market consolidation, and a lack of price transparency. This study employs a model like those used by the Congressional Budget Office, Congress’s Joint Committee on Taxation, and the U.S. Treasury Department to examine how taxing health insurance premiums would affect existing healthcare affordability and access issues.

Top-Line Results

Employment and Compensation

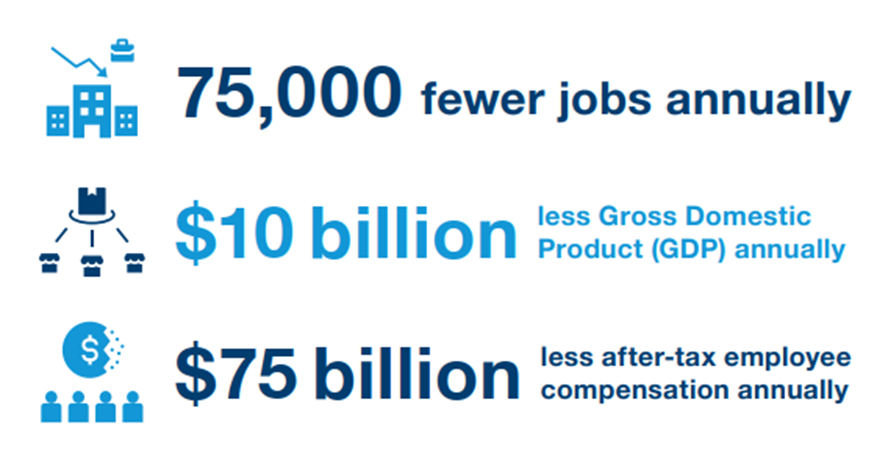

Employees would shoulder much of the economic burden under this change to employer-provided insurance tax benefits. Their tax liability would increase, lowering the employees’ overall compensation. If fewer employees are likely to have health insurance due to the higher after-tax cost of coverage, individuals might forgo or delay care, worsening health conditions and impacting productivity. An increased uninsured rate and worsened health outcomes are expected to decrease economic growth by $10 billion per year on average, driving down the job market.

Health Coverage

In this scenario, fewer people would keep employment-based coverage. Employers may start to offer lower-premium plans to avoid triggering additional taxes. Those plans may exclude certain providers, cover fewer services, or require employees to pay increased out-of-pocket costs. Employers could also consider whether to stop offering coverage altogether.

To avoid the higher after-tax cost of coverage, some employees would either switch to lower-premium employer-based health plans, enroll in Medicaid or the Children’s Health Insurance Program (CHIP), or look for plans through the individual insurance marketplace.

Ultimately, 2.8 million fewer individuals would have employer-sponsored insurance by 2035, Ernst & Young projected. While some would enroll in other coverage, many would not. This would increase the uninsured rate by 1 million people per year. A lack of insurance worsens individuals’ health, reduces access to care, and leads to 1,000 additional deaths each year, according to the study.

Long-Term Impact

Since private insurance premiums are projected to grow faster than inflation, the calculation used to value the limit of the tax benefits intensifies over time. By 2032, instead of taxing any premium contribution exceeding the 75th percentile ($11,200 for individual coverage and $27,600 for family coverage), this policy would tax any contribution exceeding the 50th percentile ($8,900 for individual coverage and $21,600 for family coverage, based on the 2026 U.S. economy). Economic and health impacts will also intensify over time as larger shares of insurance premiums are taxed.