A Journey in Cognitive AI

Most people end up in the insurance industry rather than pursue insurance as a career.

I am no exception. My journey in insurance started in 1999, when, after only three years into a career in IT, I became a project lead for an insurance integration project. AXA Group acquired Sun Life UK and our project was to migrate the policies from one company policy admin system to the other company.

Imagine a project leader with a team of 20 with no clue or meaning of the files – Premsum, Polsum, Contrts. It was tough six months to realize that Premsum is Premium Summary, Polsum is Policy Summary and Contrts is the Contracts.

With this launch into the field of insurance my journey had begun and I passionately pursued further education to be certified as CFP, CPCU, and AIAF. In my 20 plus years in insurance I have been fortunate to work with over 100 Insurance companies.

I have worked with life & retirement, P&C, brokers, and reinsurance carriers across the globe on consulting and leading many business initiatives to implement a wide variety of technology platforms.

Around 2017, I started thinking about a yet unsolved problem in the insurance industry that has been long overdue for an effective solution—efficiently and effectively identifying coverage gaps in policies.

At the same time, my friend’s basement flooded and his insurance company denied payment, stating that he lacked a water back-up endorsement. That got me curious to find out more about coverage gaps in personal policies and how can we avoid them.

I dove into the complex world of coverage gaps in personal lines and commercial lines and became more and more convinced that this is a HUGE problem worth solving.

The immediate question was—How do we identify coverage gaps in insurance policies? The simple answer is to read the policy and see if it contains the proper coverage limits and endorsements. But agents/brokers and customers don’t have effective tools and resources to identify coverage gaps without time consuming and tedious manual review.

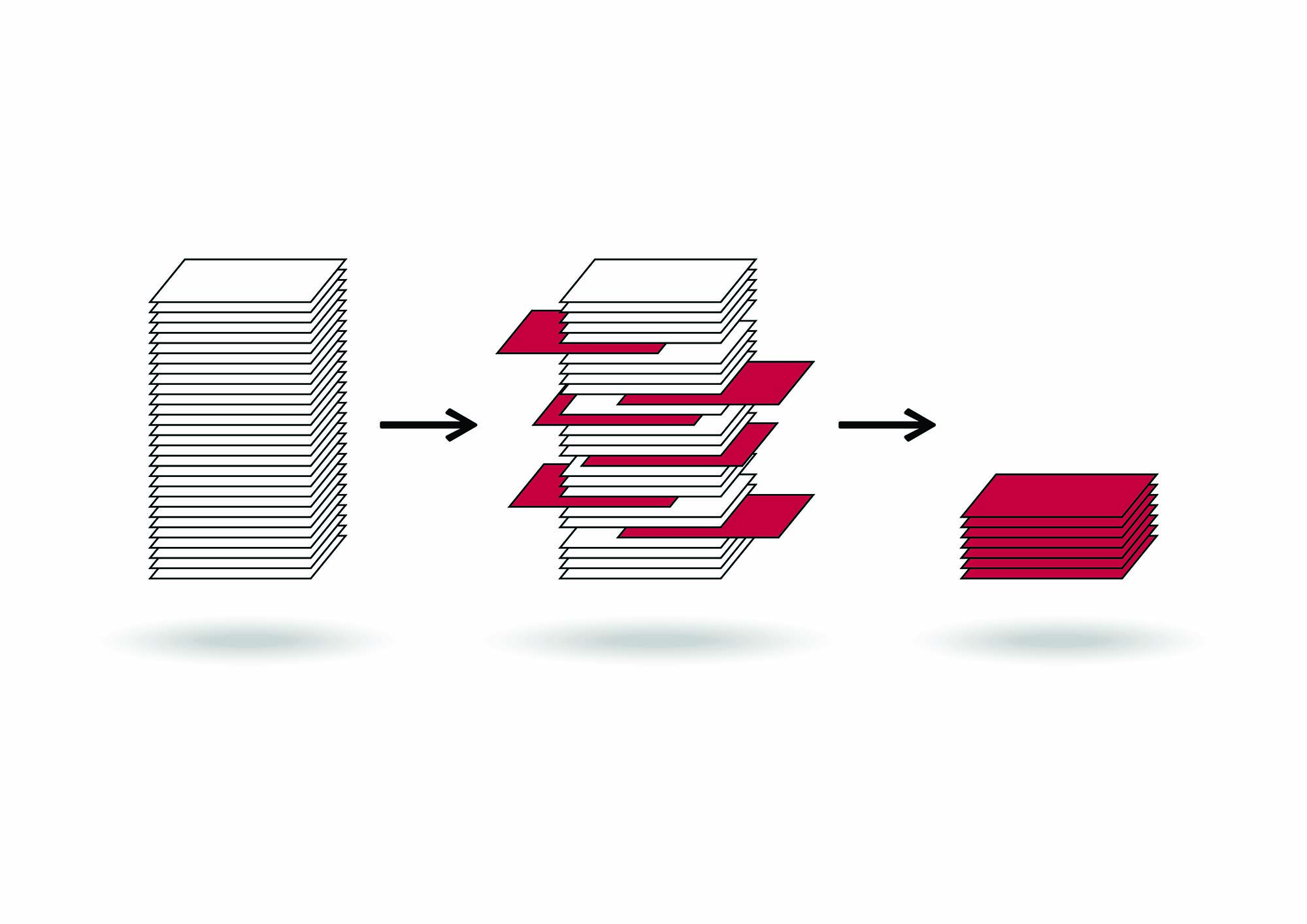

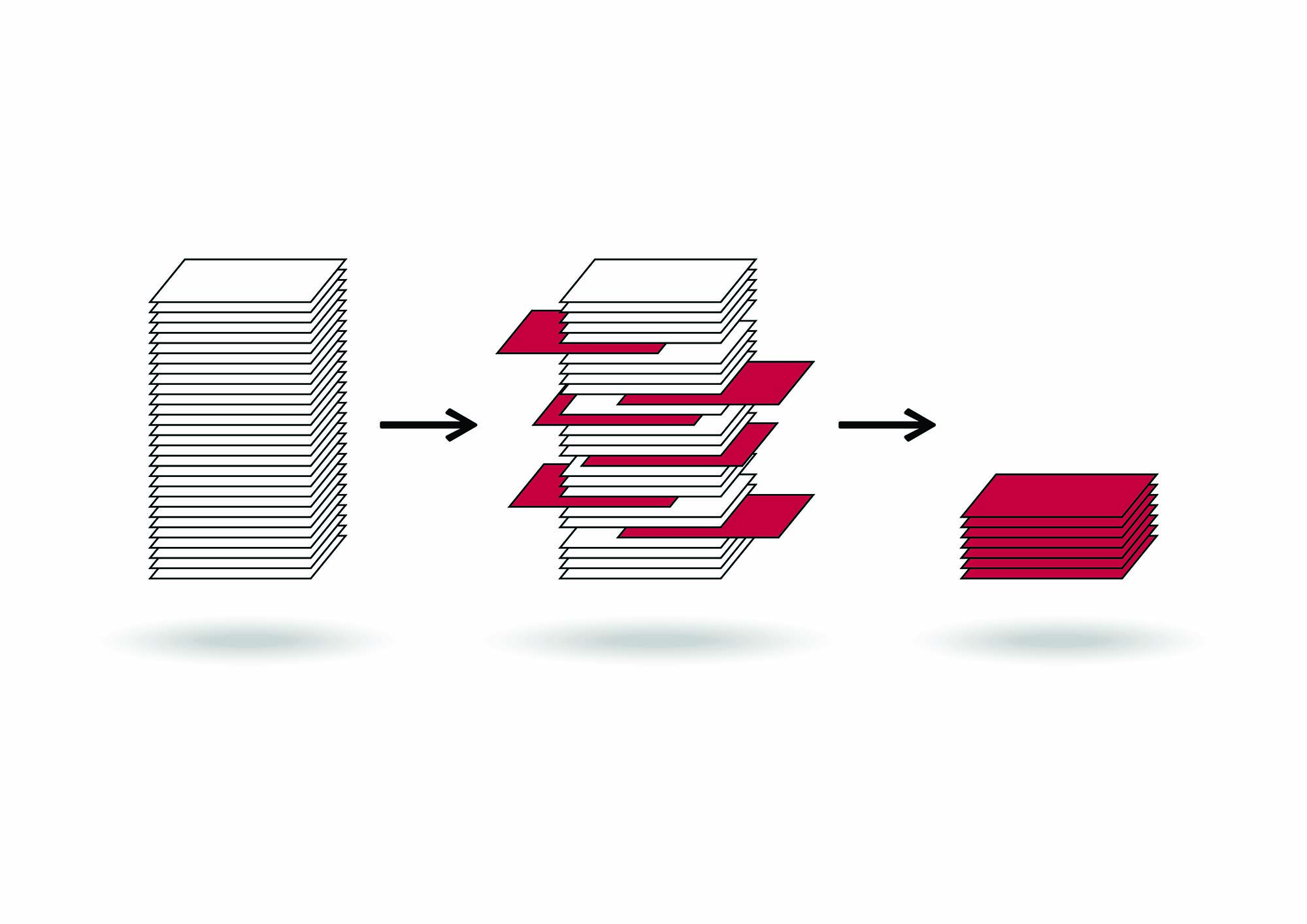

I decided to explore a key question—how do we read the policies (PDF) and extract the data needed in a structured format? I leveraged my network and challenged some of the most talented technical architects to start doing POCs. It was not an easy challenge but nothing is impossible for our chief architect, Rama Krishna Pallelapati. The policies are extremely complex and varied, and available ML algorithms did not allow us to extract data from the documents accurately and at the level of detail required. We persisted through numerous hurdles and rebuilds and ultimately built our own algorithms we could trust to deliver the data extraction accurately.

As we got better at data extraction from complex unstructured personal lines policies, we challenged ourselves to do the same extraction on even more complex files like commercial policies, loss runs, quotes, submission emails, etc. Ultimately, we determined that our algorithms could not only extract the data with high levels of accuracy across many different use cases, we could do so in a way that could greatly enhance the loss insights review process for commercial carriers and brokers. We modified our business plan to focus on three key use cases at launch: loss runs, submission insights, and insurance tracking for lenders. Focusing our efforts on loss insights in these categories will have immediate impact and will transform the highly inefficient loss run review process as it exists today. Ultimately, our program will be able to be deployed in hundreds of use cases and has the power to disrupt the industry in the best possible way.

After two years in stealth mode, we believe that we have built a powerful AI platform that is ready for market. We launched the CogniSure AI platform in September 2019 at InsureTech Connect in Las Vegas and we have been very lucky to attract the best talent with insurance and AI backgrounds.

Since our official launch last September, our journey has been tremendous and we are experiencing early traction and positive feedback from the field. We are also very fortunate that BrokerTech Ventures launched at the same time. We are lucky to be trusted by BTV partners and our inclusion in their program has been like adding fuel to the fire.

The BTV leadership team – Susan Hatten and John Jackovin – and the BTV partner companies working with us even during the peak COVID times has been truly amazing. Six of the BTV partners are engaged in pilots with CogniSure on extracting data from loss runs and we have a total of 12 pilots in progress.

There are endless opportunities and use cases with unstructured data in insurance and CogniSure AI is optimally positioned to be a leader in this space.

Sai Raman is founder and CEO of CogniSure AI.

For more information visit cognisure.ai